15+ paycheck calculator ri

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Rhode Island.

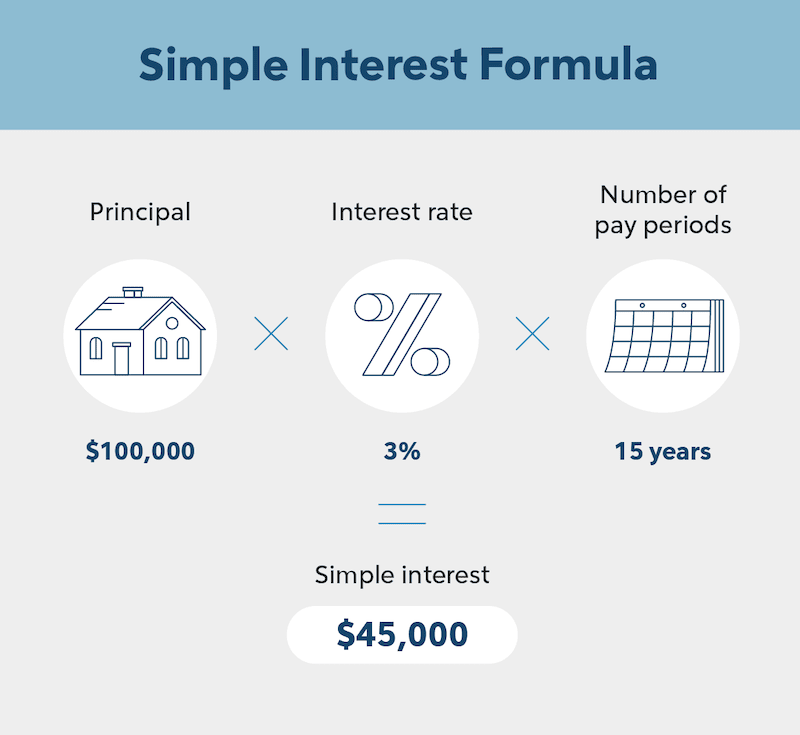

What Is Simple Interest How To Calculate It For Your Home Loan Quicken Loans

Overview of Rhode Island Taxes.

:max_bytes(150000):strip_icc()/returnoninvestmentcapital_Final-6578a691617241dfa2ab59632c84a5d3.png)

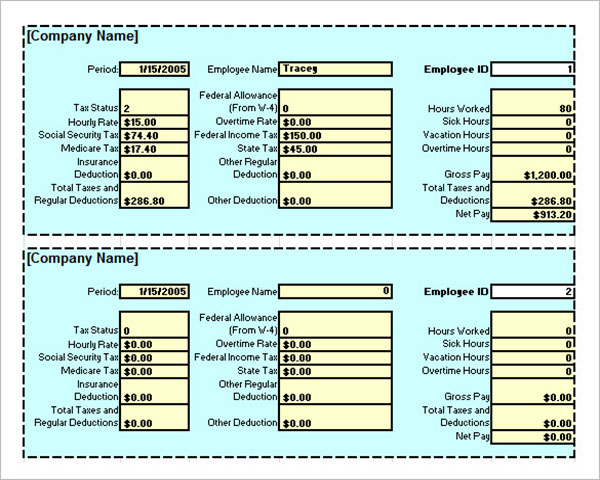

. We designed a handy payroll calculator to ease your payroll tax burden. For example if an employee earns 1500 per week the individuals annual. 51 Arm Mortgage Rates.

71 Arm Mortgage Rates. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Rhode Island. Simply enter their federal and state W-4 information.

Rhode Island has a progressive state income tax system with three tax brackets. Back to Payroll Calculator Menu 2013 Rhode Island Paycheck Calculator - Rhode Island Payroll Calculators - Use as often as you need its free. Well do the math for youall you need to do is.

Payroll pay salary pay check. The tax rates vary by income level but are the same for all taxpayers. Payroll Tax Salary Paycheck Calculator Rhode Island Paycheck Calculator Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

Supports hourly salary income and multiple pay frequencies. Rhode Island Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Rhode Island Salary Paycheck Calculator Change state Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

All you need to do is enter wages earned and W-4 allowances for each of your employees. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income.

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

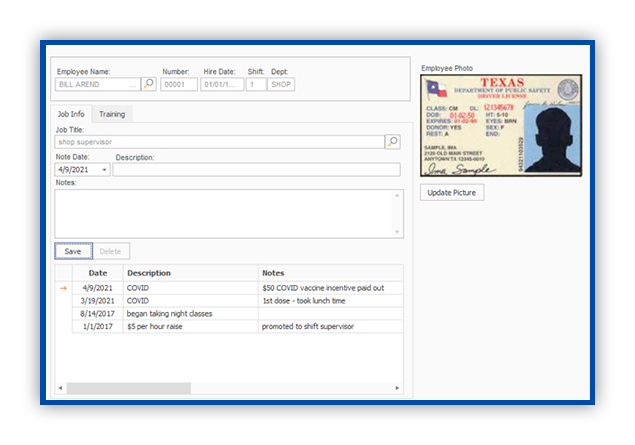

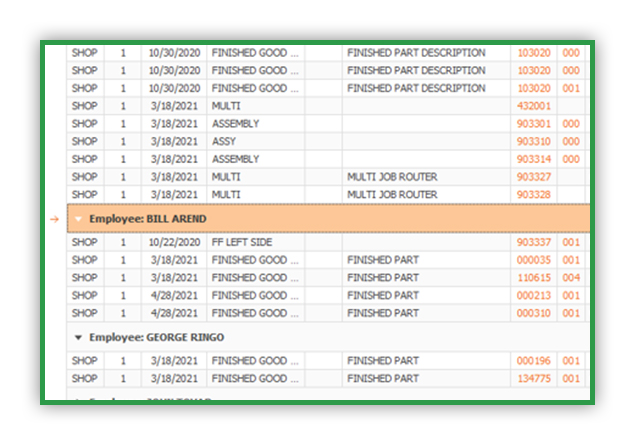

Hr And Payroll Software For Manufacturing Global Shop Solutions

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

Ktn Knowledge Transfer Manager Salaries Glassdoor

System Administrator Salary How Much Can You Earn

Rhode Island Paycheck Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

River Island Boys White Colour Ri Boxers Multipack Very Co Uk

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

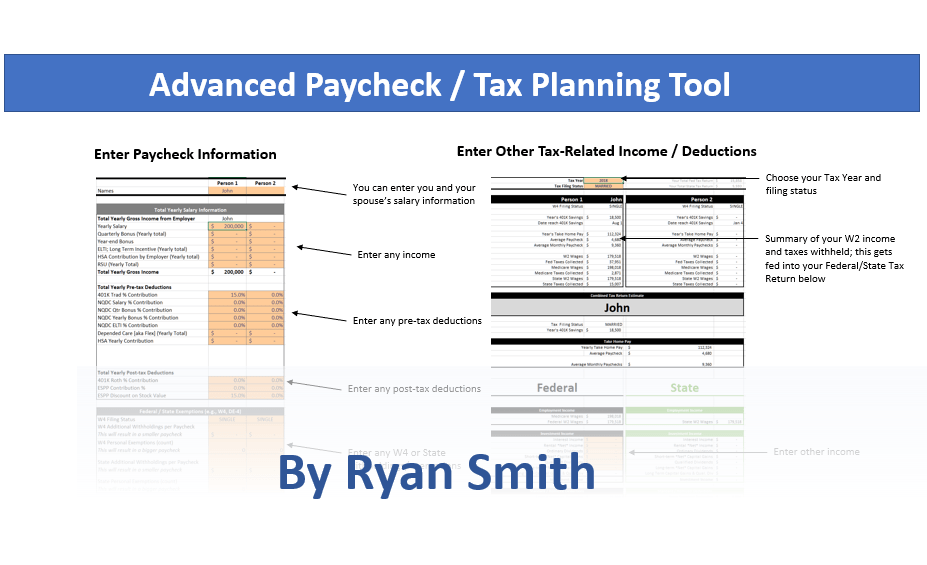

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Paycheck Calculator Us Apps On Google Play

:max_bytes(150000):strip_icc()/regression-4190330-FINAL-5aa2077b47a64bbe91b64e6715ea836b.png)

What Is Regression Definition Calculation And Example

Hr And Payroll Software For Manufacturing Global Shop Solutions

October 2010 The Rhode Island Saltwater Anglers Association

Rhode Island Salary Calculator 2022 Icalculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Ship A Car To Or From Rhode Island A Rated Auto Transport